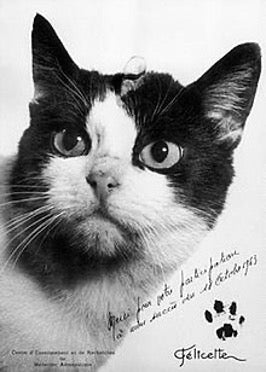

Pet insurance can be a great way for pet owners to offset the costs of providing their furry friends health care. Unfortunately, as pets get older, qualifying for insurance gets more difficult. Because aging pets are more prone to injury and illness, many pet insurers have strict age caps in place.

Luckily, not all pet insurance companies do this. If you’re looking for pet insurance for senior cats or dogs, this guide can help you find it.

Is pet insurance for senior animals worth it?

Older animals are more likely to gain weight, get sick, and be unable to fight off disease and infection. Pet insurance can help cover some or all of the costs associated with these issues. It may also help offset the costs of euthanasia and cremation services should it come to that.

Of course, insurance does mean another monthly cost, and unless your pet gets sick, that could be money wasted. Not sure if pet insurance is worth it in your animal’s case? Here are a few scenarios to consider.

When senior pet insurance makes sense

- Your pet is older—but not too old. If your pet is on the lower end of the “senior” scale (say, eight or nine), then getting insurance can be smart. They may not have developed any pre-existing conditions that would be precluded from coverage, and you’ll likely get ahead of any major health issues or costs.

- You’re short on savings or disposable income. If you don’t have the extra cash to handle a sudden medical cost, then pet insurance can be a smart choice regardless of your animal’s age. Paying $20 to $70 per month is likely a lot easier than covering a $10,000 surgery out of pocket all at once.

- You have an animal that’s prone to injury or illness. Some breeds (or even specific animals) are just more apt to get injured or sick than others. If your animal falls into this camp, then pet insurance is probably a smart move to consider.

When senior pet insurance isn’t worth it

- You have enough socked away for an emergency. If you have a flush emergency fund, then pet insurance isn’t as important. In fact, it actually may just cost you more in the long run.

- Your pet has a lot of pre-existing conditions that won’t be covered. If this is the case, you’ll likely have high vet bills for your pet, whether it’s insured or not. Adding insurance to the mix will only increase your costs as a pet owner.

How to reduce the cost of pet insurance policies for older pets

If the above pet insurance costs are looking too steep for your budget, there are several ways you can lower your monthly premium and make insuring your animal more affordable.

Here are just a few strategies you can try:

- Enroll as early as possible. The younger your pet is, the cheaper it will be to insure them. Consider signing up your animal as soon as possible to reduce your costs.

- Choose a basic policy instead of comprehensive coverage. Opting for an accidents-only policy or removing coverages can help reduce the price of your policy, too.

- Choose a policy with lower limits. The higher the annual limit is on a plan, the more it will cost you. Consider lowering your policy’s limits, and you’ll lower your insurance premiums, too.

- Up your deductible. Low-deductible plans cost more than policies with higher deductibles. Opt for a policy with a higher annual deductible, and you’ll lower your costs in step.

Some insurers offer discounts for claim-free periods, so keeping your pet healthy could lower your costs as well.

See the full guide here: Pet Insurance for Senior Dogs & Cats